GST Registration for Proprietorship

Proprietorship is the only enterprise kind below which one can function a enterprise. The only proprietorship shouldn’t be a authorized entity. It merely refers to an individual who owns the enterprise and is personally accountable for its money owed. Sole Proprietorship is the simplest type of enterprise finished in India because it isn’t ruled by any particular legal guidelines. Underneath sole proprietorship, the compliance are minimal and simple to meet. GST registration is required for incorporating a enterprise in India, so right here on this article, we’ll perceive what are the paperwork required for GST registration of a proprietorship agency.

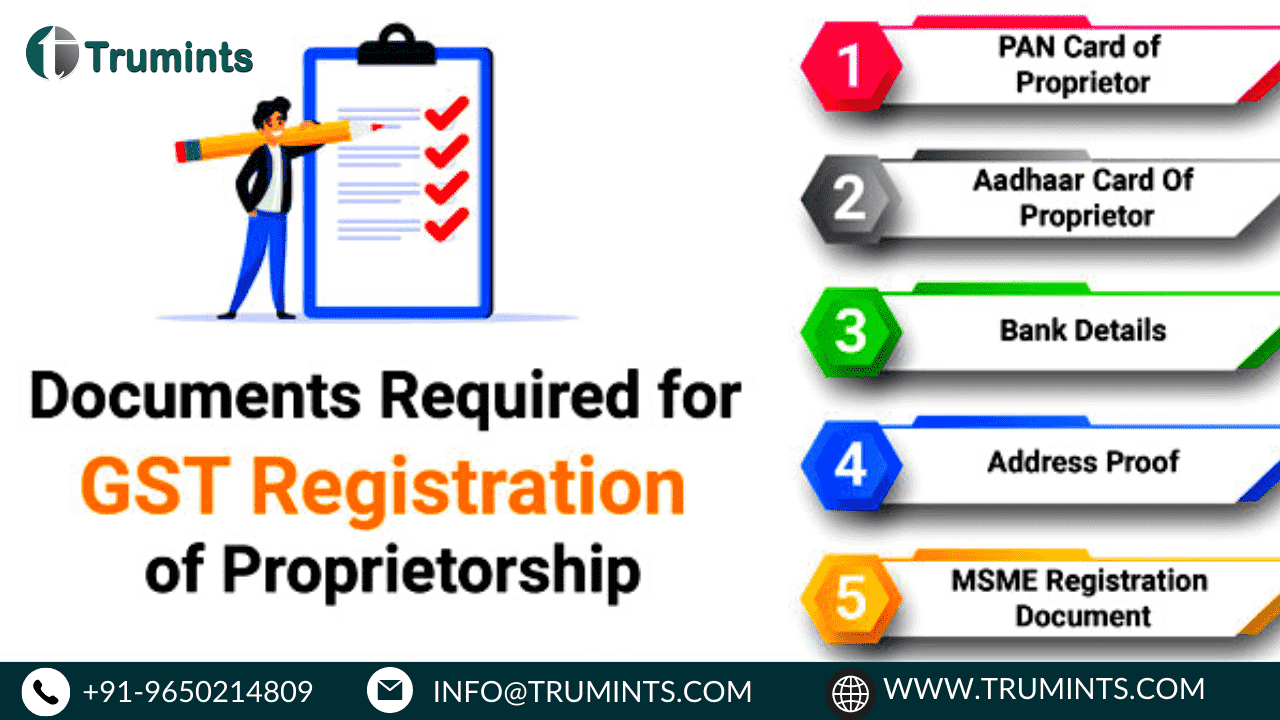

What are the Paperwork Required for GST Registration for Proprietorship?

Beneath talked about paperwork are required for GST registration for a Sole proprietorship:

PAN Card of Proprietor

PAN playing cards will be utilized on-line in addition to offline. For making use of, you want a scanned {photograph}, identification proof, and deal with proof. The shape will be submitted on-line by verifying it by means of Aadhar e-KYC.

As soon as the PAN card utility is submitted, it’s checked at NSDL for verification, and if NSDL finds the knowledge appropriate, it permits the PAN quantity inside 7-8 days. Additional, a tough copy of the PAN card is acquired on the registered deal with inside 15-20 days.

Aadhaar Card Of Proprietor

Aadhar Card is among the obligatory doc in India. Additionally, the revenue tax return can solely be filed if the individual has linked his PAN card with the Aadhar quantity. Contact the closest E-Mitra or Aadhar Seva Kendra in the event you haven’t acquired an Aadhar quantity but. After making use of for the Aadhar card, a tough copy of the identical is acquired on the registered deal with in round 15-20 days.

Financial institution Particulars

After you’ve got Aadhar Quantity and PAN, you possibly can go to any financial institution for opening an account with them. Other than Aadhar Quantity and PAN, you could carry identification proof and deal with proof. For opening a present account for a Sole proprietor, you could submit a GST registration doc to the financial institution officers too.

Tackle Proof

Within the case of a Rented Property, the registered Hire settlement and NOC from a landlord might be required.

In case of the self-owned property, an Electrical energy invoice or another deal with proof might be required.

Together with these two paperwork you can even present the paperwork talked about under:

MSME Registration Doc

MSME registration shouldn’t be obligatory for each agency in India or each small enterprise in India, however the one which falls below MSME standards can apply for MSME registration below the MSMED Act and avail varied advantages with it.

Store Act License

Every time a enterprise is began in a small agency or a store, they’ve to amass a Store act license for the betterment of the workers.

Why Register a Sole Proprietorship?

The most important motive for proprietorship registration is {that a} sole proprietorship doesn’t have a Authorities identification it turns into tough to show the existence of a enterprise. After registration one can simply open a checking account for a sole proprietorship because it will get a sound Authorities identification.

Together with that, you possibly can have full management over all of the operations, and also you get to make all the choices.

You alone can get the earnings of your enterprise.

One may also avail varied authorities advantages after Sole proprietorship registration

Even when it’s a small enterprise, you need to examine together with your tax and in addition full the authorized formalities earlier than initiating it. For higher session concerning Sole proprietorship registration, you possibly can go to Trumints.com web site and seek the advice of or specialists.

Contact Us

- Mob No-9650214809

- Mail id-info@trumints.com

- Url-www.trumints.com